Accelerating Jumbo Mortgage Delinquencies Will Bash High-End Property Values: Part 2 of 6 — Current Market Conditions: It’s Wild and Weird On the Top

(Chicago) – A quiet revolution has hit wealthy neighborhoods: financial failure. The 90-day delinquency rate on home loans worth over a million dollars hit a high in February at 13.3 percent, much higher than the overall rate of 8.6 percent.

Financial failure on large-balance mortgages and high-end properties is 50 percent higher than the national average – and the national average delinquency-rate is at record highs (High-end Homeowners Falling Into Foreclosure Trap. 5/8/2010. CNBC). Given that cure rates are approximately zero percent at 90-days of delinquency (and I mean that literally), one of eight borrowers in expensive homes is dead-and-gone. This is not a trickle. This is a flood of “product” – houses that owners or banks must sell.

Current listings will not entirely reflect this dire payment-history picture. The higher the value of the property, the more likely it is to be sold off grid. So when the bank owns a house, or when the bank is near to taking the keys, you don’t end it all with a scene of furniture in the front yard.

Current listings will not entirely reflect this dire payment-history picture. The higher the value of the property, the more likely it is to be sold off grid. So when the bank owns a house, or when the bank is near to taking the keys, you don’t end it all with a scene of furniture in the front yard.

“Lenders are far more likely to go the short sale route” for high-end properties, said Andrew LePage, an analyst at real estate research firm DataQuick. “There’s a lot more money at stake, and maintenance can be high if a foreclosure just sits there.”

***

Foreclosures of homes worth over $1 million reached a high in February 2010, the last month data is available, when 4,169 homes were somewhere in the foreclosure process. It’s greater than double the level of a year ago.

Twelve percent of million-dollar sales (37 sales of 295) in the Chicago-area were distressed sales between January and April of this year, and I am confident in saying that stress plays a significant role in expensive markets all across the country – based upon the pay history with 13.3 percent of million dollar loans at 90-days past due. The same ratio-of-distress stood at only four percent in the beginning of 2009. The stress factor in sales has tripled this year.

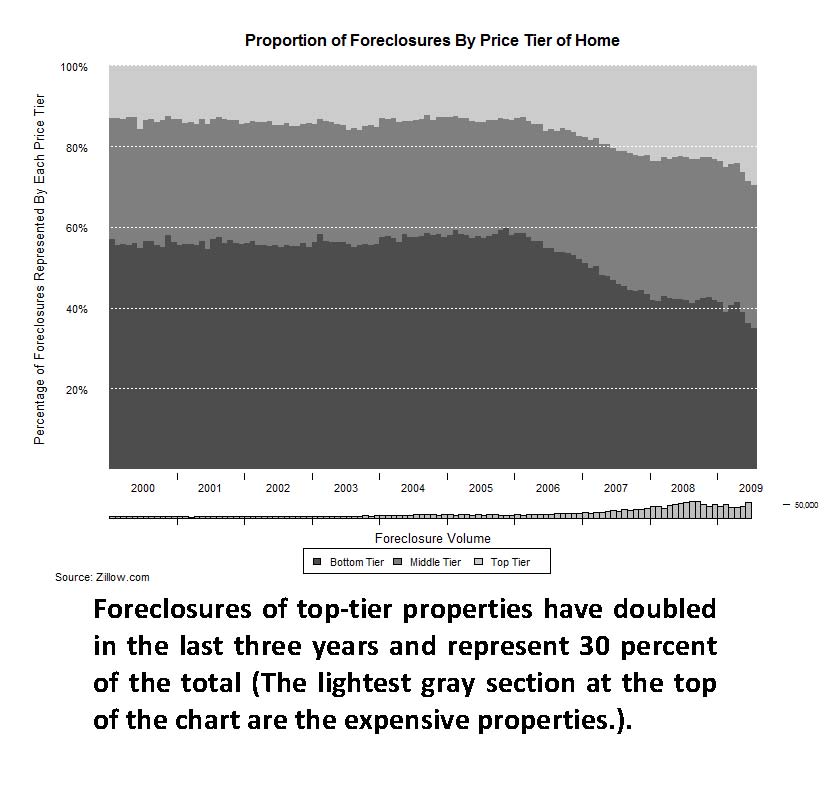

While inventory for-sale may not yet fully reflect the delinquencies, foreclosures prove distress at the high-end. Thirty percent of foreclosures are homes in the top tier of local home values. They make up almost twice the proportion of foreclosures as they did three years ago, according to Stan Humphries, Chief Economist for Zillow (Please see the chart below. Click on the chart for a larger image.).

Realtors and sellers of expensive homes are fighting a few new battles unique to our current time and place.

New appraisal companies, paid for production and speed, are churning out prices which make no distinction between a sale in distress and a normal sale. The bias in appraisal values has swung from high to low (Appraisers and Foreclosure Sales Bring Havoc to Housing Markets. Nov 2009. Foreclosure News Report.).

Before it was weird to have a distressed sale and that sale price wouldn’t be used as a comparable sale. Now it is normal to have a distressed sale and the appraiser will pre-judge the lower sale as better because he won’t be accused of high-balling the price. Today’s baksheesh is yesterday’s stale baklava.

The typically-priced homes (not high-end) also benefit from an encyclopedia of federal intervention in the conforming mortgage market (Conforming loans are less than $417,000.). Unlimited funds are available for smaller new mortgages. They are funded by the Treasury which is spending without restraint. The increased distress in expensive home prices and jumbo mortgages derives in part from the stricter standards required by private lenders for new mortgages in a higher-risk mortgage category.

Let’s not forget too that distress in expensive markets is part of a radical fall in property prices nationwide. Values have undergone a 120-year-severity bubble-and-bust. Thirty percent of high values have disappeared over the last four years. Does anybody still say a home will never lose its value? Only people whose thoughts have been recorded, but who are no longer speaking: The dead speak this way when they talk about Jack and the Bean Stalk and ever-higher property values.

***

The “normals” market has also stabilized more because delinquent-mortgage borrowers may turn to modification programs to catch up. Buyers in general are also less ambitious today and more frightened of taking on big debts. The new higher priority is to have a home and mortgage which you can afford.

“We’re in a ‘trade-down’ environment for the first time since the 1930s,” says Kenneth Rosen, chairman of the Fisher Center for Real Estate and Urban Economics at the University of California, Berkeley (High-End Homes Frozen Out of Budding Housing Rebound. 8/3/09. WSJ.).

High-salary white-collar workers are not immune to job loss. Investment banking bonuses may have changed from cash to stock that must be held for several years. Wealthier homeowners may have a pay-option or interest-only loan which is underwater and whose liberal terms are not available in a refinance even if there was equity in the house (Jumbo Mortgage Delinquencies Soar as High-End Home Inventory Builds. 1/13/10. Daily Finance.)

High-salary white-collar workers are not immune to job loss. Investment banking bonuses may have changed from cash to stock that must be held for several years. Wealthier homeowners may have a pay-option or interest-only loan which is underwater and whose liberal terms are not available in a refinance even if there was equity in the house (Jumbo Mortgage Delinquencies Soar as High-End Home Inventory Builds. 1/13/10. Daily Finance.)

JP Morgan reported rising inventory for-sale over $750,000 at the beginning of the year and projected recovery is not in the cards this year and not in the cards next year but only in the year after that (2012). They also predict peak-to-trough declines greater than 60% in the high end. They estimated damage in a market-wide assessment at 40%.

Many wealthy property owners operated under the assumption that high-end properties do better at holding their value or never lose value, but there’s good reason to believe the opposite is true, and I will tackle that subject in a later post.

***

To summarize, serious jumbo mortgage delinquencies are 50 percent higher than the overall market. The number of distressed sales in that category has tripled in the last year in the Chicago area; and that trend toward distress is probably true far and wide. It has to be given what we know of the mortgage-delinquency trend. Thirty percent of all foreclosures are top-tier properties and that is a doubling of the rate when compared to three years ago. Our current zeitgeist is a trade-down environment with low-ball appraisals. Government subsidies do not cover most mortgages in expensive-property markets. And values are projected to fall 60 percent for expensive properties from peak to broken-bubble bottom.

One other thing Mrs. Lincoln: Do you think you will come and see this play again?

***

PRINT – Part 2 Jumbo Mortgage Delinquencies Bash High-End Properties

Check back soon for Part 3 of our six part series “Accelerating Jumbo Mortgage Delinquencies Will Bash High-End Property Values”.

Comment by Maryam Kaur on 4 October 2010:

i really hate to get a mortgage but sometimes you just can’t avoid getting one;;”

Comment by Eyelet Curtains on 19 October 2010:

i really do not like to mortgage any of my property, mortage sucks anyways’:-