money

Proof of U.S. Greater Depression

The statistical charlatans at work for the U.S. government can pretend there is positive GDP growth. They can pretend there is positive jobs growth. But they cannot pretend to consume energy.

19Feb2012 | JeffNielson | 1 comment | Continued

Deadbeats ‘Bailing Out’ Deadbeats

Surely even the media drones and market “experts” can understand the concept that one deadbeat with no money cannot (financially) bail out another deadbeat with no money?

7Feb2012 | JeffNielson | 5 comments | Continued

Exposing Silver Mythology, Part I

What then are we to make of the fact that the self-described (mainstream) “experts” on the silver market, the “official” sources for data on the silver market, and the primary regulator of the silver market all regularly and consistently demonstrate complete ignorance of even the most elementary of economic principles? Are we to attribute this to gross incompetence, inherent bias, or an intentional attempt to deceive?

24Jan2012 | JeffNielson | 1 comment | Continued

The ‘Perils’ of a Gold Standard?

A gold standard does not “cause” depressions (governments do). However, at the same time, a gold standard is also not a magical, economic panacea. Specifically, imposing the fiscal discipline inherent in a gold standard will not lead to a good economic outcome in the hands of a corrupt government (i.e. one which governs for the benefit of the privileged few as opposed to the majority).

19Jan2012 | JeffNielson | 3 comments | Continued

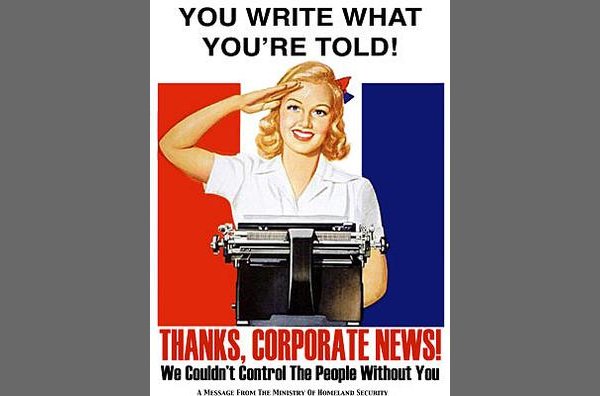

Is The Gold Bull “For Real?”

For those not following closely, gold just put in its 11th consecutive yearly price increase, with an approximately 14% rise on the calendar year… but you probably haven’t heard of it. In fact, you probably think that “gold is going down”, based on what you’ve heard in the media recently (if not continuously for the past 5 years or so). An interesting question then remains: why has this disconnect occurred?

4Jan2012 | admin | 5 comments | Continued

How The Bankers Drive Up Bullion Prices, Part II

Countering the inherent efficiency of the junior mining model is the relentless manipulation of the banksters. It is an unavoidable reality for most of these miners that they must obtain their financing for operations from the vampiric banks through equity-based financing rather than straight loans.

1Jan2012 | JeffNielson | 2 comments | Continued

How The Bankers Drive Up Bullion Prices, Part I

We have a sector of companies generating record profits, huddled within entire economies which will soon be in a state of total collapse. This is to be followed by what we can conservatively expect to be a 1000% increase in total investment, by a throng of investors being simultaneously driven by extreme fear and extreme greed.

19Dec2011 | JeffNielson | 0 comments | Continued

The Land of Anti-Gold Propaganda

“Getting all governments to devalue their currencies simultaneously is the most effective means to hide the total destruction of our currencies from the near-comatose sheep. Returning to the analogy of two people jumping off a tall building, to each other neither appears to be moving – or at the very least it drastically reduces their perception of the speed at which both are falling.”

14Dec2011 | JeffNielson | 0 comments | Continued

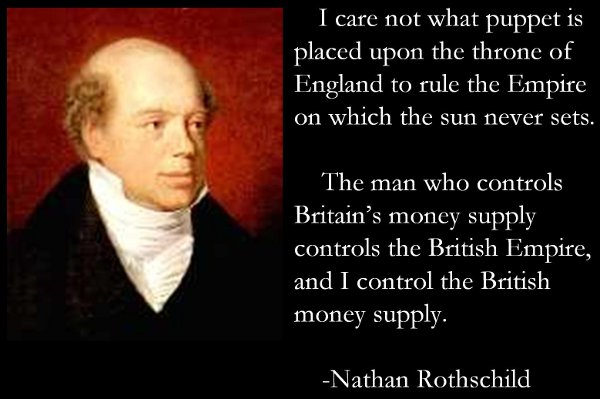

Gold “Monetized” Honestly vs. Dishonestly

We look at two current contrasting cases of monetization of gold — one is honest and promotes monetary soundness and stability, the other is dishonest and promotes further financial and monetary crisis. Can you guess which form is being executed by the lay public, vs. the monetary authorities and big banks?

13Dec2011 | admin | 0 comments | Continued

Don’t Blame The Millionaires

There is no reason for the media to be blaming “millionaires” for wealth inequality. Yes, they too have benefited from the lowest tax rates in history for those on top. However, there is a huge conceptual difference between the millionaires (or even billionaires) and the trillionaires.

5Dec2011 | JeffNielson | 5 comments | Continued