antispin

Gold, Orange Juice, and ‘Tang’

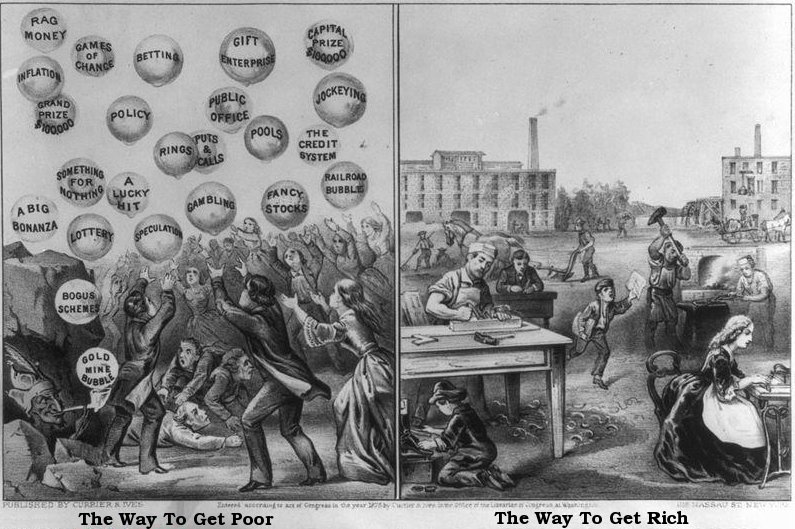

Just as savvy beverage-drinkers will inevitably shun excessively diluted Tang, eventually our deluded masses will figure out the bankers’ paper scam — and react accordingly. There is a very precise name for this economic phenomenon: hyperinflation, where paper fiat currencies go to zero.

24Nov2011 | JeffNielson | 0 comments | Continued

Bankster-Created Commodity Crisis Intensifies

The most recent (and most terrifying) example of bankster commodities-manipulation crimes against humanity is in the massively important global cooking oils market. Affluent Westerners may not fully appreciate the tremendous importance of this market (and global stockpiles of those oils); however it is arguably the most important niche in global food production.

24Nov2011 | JeffNielson | 0 comments | Continued

Save Taxes With Gold And Silver Money

For all the holders of official gold and silver money, who would like their own opportunity to benefit from tax-loopholes (just like the top-1% do); just spend some of that money during the course of your ordinary shopping. It’s all perfectly legal.

16Nov2011 | JeffNielson | 1 comment | Continued

Interview with Charles Savoie on TPTB of Silver Manipulation

Charles links a relatively small but extremely powerful group of individuals (and often their descendants) together through two common “threads”: their propensity for actions which were extremely detrimental to the silver market and/or the holders of silver; and their membership in a little-known organization which they have called “The Pilgrims”.

11Nov2011 | JeffNielson | 6 comments | Continued

Silver: Shorting Consumes, Investing Conserves

There is less silver in the world today on a per capita basis, and less silver in the world today in relation to the supply of gold than at any other time in at least 600 years, prompting Ted Butler to dub silver “The Rarest Earth”.

10Nov2011 | JeffNielson | 8 comments | Continued

Silver: The People’s Money

Lacking a gold standard and lacking any financial regulation of these multinational banks, as individuals we have been left with absolutely no recourse but to “insure” our wealth by converting it to silver.

7Nov2011 | JeffNielson | 0 comments | Continued

U.S. Faces Much Worse ‘Japanization’

An amount of liquidity equivalent to roughly ¼ of the entire global economy has been pumped into Wall Street to prevent the banksters’ fraud-saturated bubbles from deflating. To refer to this as a “post-bubble economy” is like referring to the nation of Japan as being “post-Fukushima” the day after the first meltdown.

1Nov2011 | JeffNielson | 1 comment | Continued

‘D-Day’ Near For GLD

…GLD has never warranted itself to be anything more than an index fund: a vehicle for trading in paper gold. It offers the absolute minimum to investors in the way of security, while exposing them to numerous counterparty risks.

In roughly two weeks time, unit-holders can add a new risk to their list of worries: the potential for virtually unlimited dilution…

27Oct2011 | JeffNielson | 0 comments | Continued

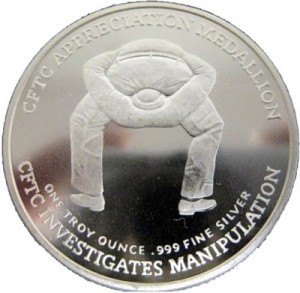

SLV And Silver Manipulation

JP Morgan is the largest silver short-seller in the history of the world. JP Morgan is the “custodian” for the largest “long” silver fund in the history of the world, making this one of the largest conflicts of interest in all of history.

24Oct2011 | JeffNielson | 1 comment | Continued

Preemptive Strike Against Precious Metals Nears End

While we all know never to say “never” in this market, it appears that the latest operation has neared its expiry date. Put another way, it does not appear feasible that the investment community could remain “witless” enough not to fathom the impact of more, massive money-printing.

19Oct2011 | JeffNielson | 0 comments | Continued